Subscribe to Un-covered Essentials

Insurer policies limit coverage and disrupt patient care, while producing record profits for corporate shareholders. Stay informed with the Un-covered newsletter.

Payors are skilled at deflecting the blame for high healthcare costs, even while enjoying record profits. Here's how it's done.

A couple of years before I left Cigna, I was in a leadership meeting that was typically uneventful until someone asked Ed Hanway, the CEO at the time, what kept him up at night.

“Disintermediation,” Ed said, without a second of hesitation. For those not familiar, that’s the technical term for “cutting out the middleman.”

He went on to explain his worry that someday, America’s big employers would start questioning health insurers’ value proposition and view them as just that— unnecessary middlemen.

Hearing this, I immediately perked up because as head of corporate communications, one of my major job objectives was to keep the public convinced that private payors play an essential role in our healthcare system and that the status quo is nothing to tinker with.

Ed retired not long after that and is now probably sleeping well, but today’s CEOs undoubtedly are concerned that the “someday” Ed worried about might be close at hand. You can be certain they’re well aware that the big, self-insured customers they care most about are not happy with how insurers are managing their—and their employees’—money.

A big part of my work back then was to point the finger of blame for rising healthcare and health insurance costs at everybody else, not us. I never missed an opportunity to talk about what we called the “true drivers” (or “key drivers”) of medical inflation. The guilty parties—in my telling— were greedy doctors, drug and medical device companies and big hospital systems that charged too much and kept jacking up their prices. Also among the guilty, I’d hasten to add, were regular folks who go to the doctor too much and overuse the healthcare system.

The finger-pointing preceded my time in the industry, and it continues to be a central element of payors’ messaging strategy. That’s because it works. As any magician will tell you, you can obscure what you don’t want people to notice by using a technique they’ve used forever: misdirection. Insurers want you to look at the fingers pointing away from them, not at the ones picking your pocket.

An important goal of the industry’s misdirection is to keep customers and other important people from asking a question you’d think would be obvious: If insurers can’t do much about those “key drivers” other than to point them out and complain about them, what, exactly, is the industry’s “value proposition”?

To keep members of Congress in particular from asking that question, insurers have pressed one of their big trade groups, America’s Health Insurance Plans (AHIP), into service. To add credibility to the work, AHIP has enlisted the support of a long-time messaging partner: the big accounting/consulting firm PricewaterhouseCoopers (PwC).

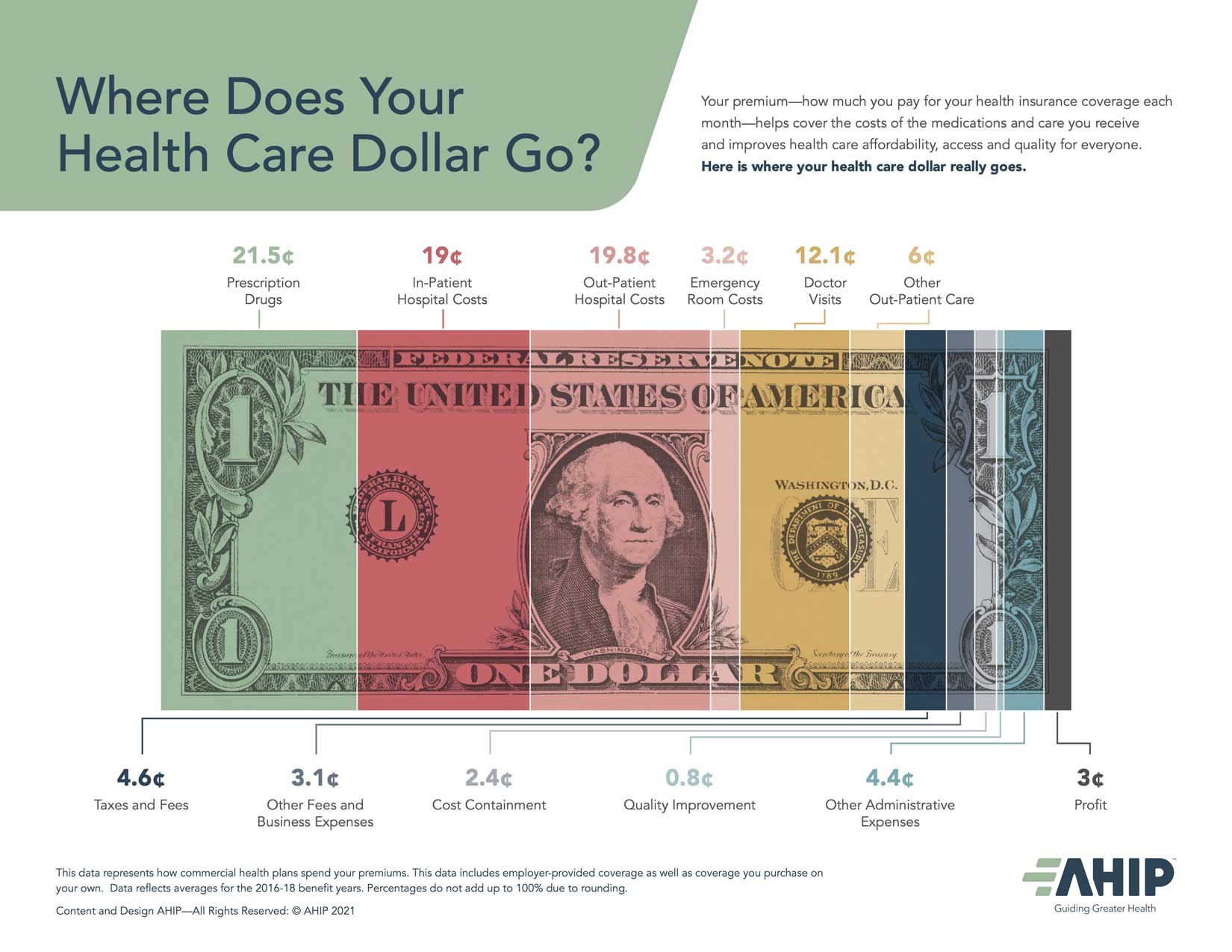

The AHIP/PwC team has produced several official-looking “policy briefs” over the years as well as a nifty graphic that pops up in the form of billboard ads in Washington D.C.’s Metro stations whenever lawmakers start making noise about health insurance reform.

The graphic is a colorful dollar bill marked up to ostensibly answer the question: Where does your healthcare dollar go?

If you look at how that graphic has changed over time, you’ll notice that some of the categories swell while others shrink. A bigger chunk of our premium dollar now goes to buying prescription drugs—21.5 cents now compared to 14 cents in 2012 (when I wrote about how insurers tried to fool Congress with fuzzy math)—according to AHIP/PwC. The higher drug spend is not necessarily surprising when you consider that many medications are quite expensive. Because these drugs are likely keeping more people out of the hospital, reducing the overall cost of care, this isn’t without some benefit to patients. To insurers’ delight, the growth in spending on prescription medications is why lawmakers have drug makers, and not them, in their sights at the moment.

If you’re wise to what AHIP and PwC are up to, you’ll notice how they now cleverly break into pieces the portion of the dollar insurers grab and keep for themselves and their shareholders. You have to go to the trouble of adding up those pieces to see that close to a fifth of our premium dollars goes not to keeping us well but to covering insurers’ profits, taxes and overhead expenses. When you compare the 2021 version of AHIP/PwC’s chopped up bill to the 2012 version, you’ll see that insurance companies are getting more of your dollar than they did in 2012.

Some employers appear to be catching on to the industry’s sleight of hand and could be on the verge of publicly questioning insurers’ value proposition. A recent survey of CEOs of several big companies, conducted by the Kaiser Family Foundation and the Purchaser Business Group on Health (PBGH), showed that a huge majority say the expense of the current system is not sustainable for their businesses, not even in the short term. Not only are they sick and tired of devoting more and more of their revenues to health insurance premiums, but they also hate having to saddle their employees with insurers’ out-of-pocket requirements, which are now far beyond what many workers can afford.

A few weeks after that survey was released, PBGH and the Colorado Business Group on Health (CBGH) announced a partnership to find ways for their member companies to contract directly with hospital systems and disintermediate the middleman, as Boeing has been doing with considerable success for a few years now. That will only work for employers with a lot of workers in one market, but many of PBGH’s and CBGH’s member companies are big enough to pull it off. Meanwhile, the consulting firm Health Rosetta is helping employers of all sizes reduce their healthcare costs and improve employee health and satisfaction by sidelining the middleman in various ways.

These developments undoubtedly are more than a passing concern for health insurance CEOs and their PR people. You can be certain that the possibility of disintermediation catching on is one of the reasons insurers’ growth strategy has shifted from buying smaller competitors to buying physician practices and clinics and merging with pharmacy benefit management companies and retailers. They see the writing on the wall and are rushing to diversify, in part by becoming healthcare providers themselves.

But don’t expect the industry’s misdirection machinery to grind to a halt anytime soon. Congress will eventually set its sights on payors again. When that happens, you’ll be seeing AHIP/PwC’s dollar bill all over Washington D.C. again.

Insurer policies limit coverage and disrupt patient care, while producing record profits for corporate shareholders. Stay informed with the Un-covered newsletter.